Information Security

Next of Kin Scam

Last modified 2/24/2025

What is the "Next of Kin" Scam?

Cybercriminals frequently use inheritance scams to exploit unsuspecting individuals by promising a share of a large, unclaimed sum of money. The scammer usually claims to be a bank official, attorney, or government representative reaching out because a wealthy individual has passed away without naming a next of kin. The recipient is told they can claim the inheritance if they agree to cooperate.

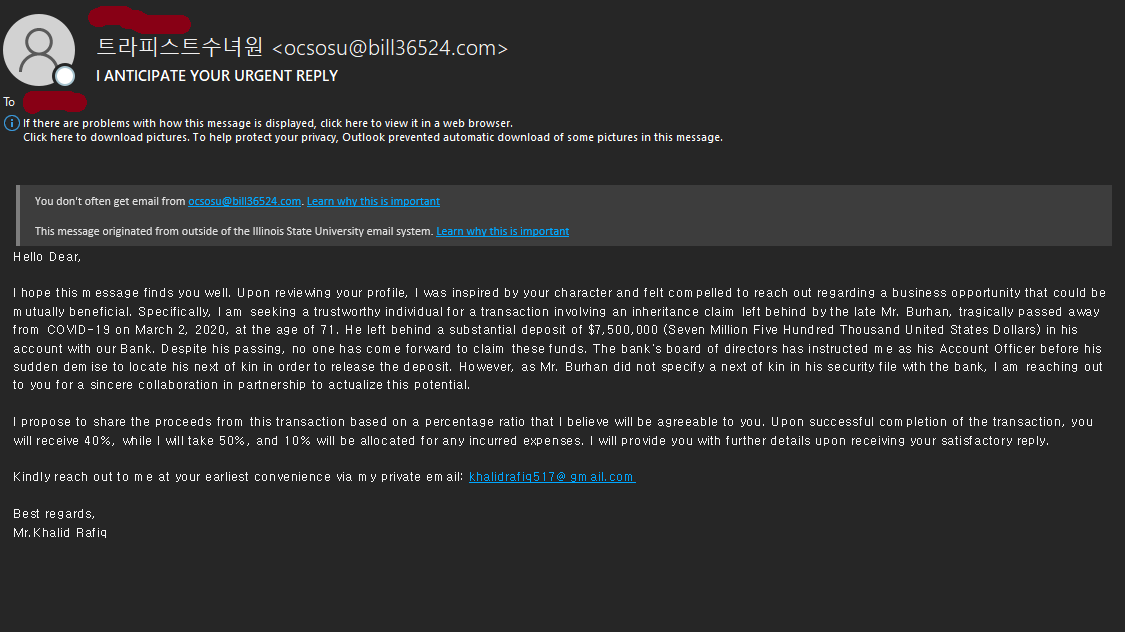

One recent example targeted an Illinois State University employee, promising a fake $7.5 million inheritance left by a supposed Mr. Burhan. The scammer, impersonating a financial officer, requested "collaboration" and suggested a percentage split of the funds in an attempt to build trust.

Red Flags to Watch For

Unexpected Contact

- If you receive an email about a large inheritance from someone you don’t know, it’s a scam. Banks and legal offices do not seek out random individuals for such matters.

Suspicious Email Address

- The sender’s email was ocsosu@*****6524.com, which is not associated with any legitimate financial institution.

- The scammer later asks the recipient to reply to a different personal email address (kha******517@gmail.com), a common trick used to bypass email security filters.

Vague and Flattering Language

- The scammer uses generic greetings ("Hello Dear") instead of addressing the recipient by name.

- The message includes false praise, claiming they were "inspired by your character" after viewing your profile—this is a psychological trick to build trust.

Offer Sounds Too Good to Be True

- Scammers often promise a large sum of money in exchange for minimal effort.

- The proposed percentage split (40% for you, 50% for them, and 10% for expenses) is meant to sound fair and realistic—but it’s all fake.

Urgency and Secrecy

- The email urges the recipient to reply quickly, increasing the likelihood of impulsive action.

- The scammer avoids details about legal verification, which would be required for a real inheritance claim.

How the Scam Works

Once a victim responds, the scammer typically:

- Requests personal details, such as full name, address, phone number, and bank account information.

- Claims that legal fees, taxes, or transfer charges must be paid before receiving the funds.

- Disappears after collecting payments or uses stolen information for identity theft.

How to Protect Yourself

✅ Do not respond. Ignore any unexpected emails promising inheritance money.

✅ Verify with a trusted source. Contact your bank or legal representative if you have concerns.

✅ Look for external email warnings. ISU flags suspicious emails from outside the university system to help identify scams.

✅ Report phishing attempts. Forward suspicious emails to abuse@ilstu.edu or use the "Report Phishing" feature in Outlook.

Final Thoughts

If something sounds too good to be true, it probably is. Scammers rely on curiosity, greed, and urgency to trick victims. Stay alert, trust your instincts, and always verify unexpected financial offers before taking any action.